The law allowing borrowers to switch from Swiss francs to lei at the exchange rate valid on the date the loan contract was signed is unconstitutional, the Romanian Constitutional Court ruled on Tuesday. The Court President, Valer Dorneanu, said the most important aspect taken into account was a severe violation of the principle of bicameralism.

Valer Doneanu: “The fact that the Chamber of Deputies, the lower chamber in Parliament, is the decision-making body in this case, does not mean that it may endorse a bill in any form they like. On the contrary, Deputies are bound to take into account the text endorsed by the higher chamber, namely the Senate. Furthermore, the Court found that the solution chosen by the Chamber of Deputies, that is, the conversion of Swiss francs to lei at the exchange rate valid at the time when the loan contracts were signed, is wrong and comes against all European directives.

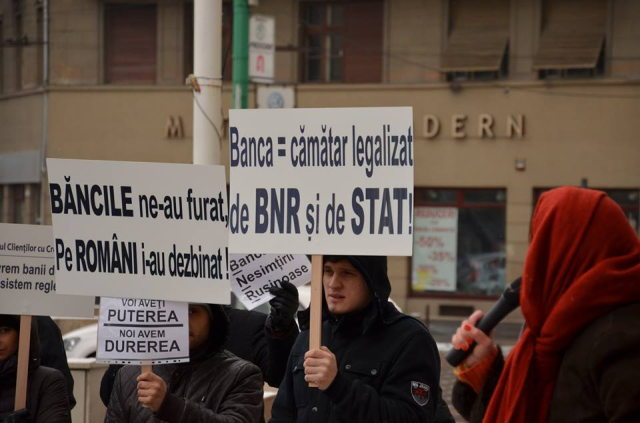

The Constitutional Court had postponed its decision twice already, in order to look more deeply into the matter. In October 2016, the Chamber of Deputies decided in a bill that loans taken out in Swiss francs should be swapped for national currency loans at the exchange rate valid when the contract was signed. The law was quickly brought before the Constitutional Court by the Government, and Dacian Ciolos, the Prime Minister in office at the time, explained that the Government had done that not because it opposed it, but rather for clarifications.

According to central bank data, in January 2015 there were over 65,000 borrowers in Swiss francs in Romania, and by June nearly half of them had requested a conversion or rescheduling of their loans, as currency fluctuations had doubled their repayment amounts. At present, the Swiss franc accounts for roughly 4.2 lei, as compared to 2-2.5 lei in 2007-2008, when most of the Swiss franc loans were taken out. Swiss franc lending was encouraged at the time by the much better interest rates than the ones charged on loans in Euros or USD.